Fast, affordable Internet access for all.

Saint Louis Park, a compact community along the west side of Minneapolis, has built an impressive fiber network, a conduit system, and several deals with developers to ensure new apartment buildings will allow their tenants to choose among high speed Internet access providers. Chief Information Office Clint Pires joins me for Community Broadband Bits podcast 219. In one of our longest episodes, we discuss how Saint Louis Park started by partnering with other key entities to start its own fiber network, connecting key anchor institutions. Years later, it partnered with a firm for citywide solar-powered Wi-Fi but that partner failed to perform, leaving the community a bit disheartened, but in no way cowed. They continued to place conduit in the ground wherever possible and began striking deals with ISPs and landlords that began using the fiber and conduit to improve access for local businesses and residents. And they so impressed our previous podcast guest Travis Carter of US Internet, that he suggested we interview them for this show. Clint Pires has learned many lessons over the years and now we hope other communities will take his wisdom to heart. Well-managed communities can make smart investments that will save taxpayer dollars and drive investment in better networks.

This show is 40 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Roller Genoa for the music, licensed using Creative Commons. The song is "Safe and Warm in Hunter's Arms."

On September 6th, the Nashville Metro Council approved a proposed One Touch Make Ready (OTMR) ordinance by a wide margin of 32-7 on a roll call vote (computers were down). This was the second vote to advance the ordinance, designed to streamline deployment of fiber-optic networks in a city looking for better connectivity. Elected officials responded to Nashville residents who flooded their council members’ offices with emails.

The Nashville Metro Council will take up the ordinance one last time; passage could speed up competition in the country music capital. Google Fiber has been pushing for a OTMR, while incumbents AT&T and Comcast look for a non-legislative solution to the problem of the poles while protecting their positions as dominant Internet Service Players (ISPs).

Caught Between A Rock And A Hard Stick

The city of Nashville sits on limestone, a rock that cannot support the trenching and underground work of fiber deployment. The only other option is to use the utility poles. Eighty percent of the poles are owned by the public utility Nashville Electric Service (NES), but incumbent provider AT&T owns the other 20 percent. Google Fiber says it needs to attach fiber to 88,000 poles in Nashville to build its network and about half of those (44,000) need to be prepared to host their wires.

Pole attachments are highly regulated, but there are still gray areas. Susan Crawford provides an overview of the policies and regulations on BackChannel; she accurately describes how poles can be weapons that guard monopoly position. Currently, each company that has equipment on the poles must send out a separate crew to move only their own equipment. This process can drag on for months. The OTMR ordinance is a deceptively simple solution to this delay.

Deceptively Simple, But Regulated

In this week's Community Connections, Christopher chats with Anne Schweiger, Broadband and Digital Equity Advocate for the city of Boston. Schweiger talks about the challenges that Boston faces, including a lack of competition and adoption of broadband in the home. She talks about the importance of "baking good broadband practice" into building codes for cities.

In February, 2016 the Boston Globe editorial board came out in support of a municipal network.

Boston has its own conduit network and significant fiber assets, but residents and businesses must seek service from large private providers.

The 6th Circuit Court of Appeals decided to dismiss the FCC's decision to encourage Internet investment in Tennessee and North Carolina

Minneapolis, MN - The 6th Circuit Court of Appeals decided today to dismiss the FCC's February 2015 decision to encourage Internet investment in Tennessee and North Carolina. Tennessee and North Carolina had both restricted local authority to build competitive networks.

"We're disappointed that the FCC's efforts to ensure local Internet choice have been struck down," says Christopher Mitchell with the Institute for Local Self-Reliance. "We thank the FCC for working so hard to fight for local authority and we hope that states themselves will recognize the folly of defending big cable and telephone monopolies and remove these barriers to local investment. Communities desperately need these connections and must be able to decide for themselves how to ensure residents and businesses have high quality Internet access."

ILSR and Next Century Cities filed an Amicus brief in support of the FCC's position. View the Court's Opinion here.

Contact:

Rebecca Toews

612-808-0689

In celebration of Independence Day, we are focused this week on consolidation and dependence. At the Institute for Local Self-Reliance, we are very focused on independence and believe that the consolidation in the telecommunications industry threatens the independence of communities. We doubt that Comcast or AT&T executives could locate most of the communities they serve on a blank map - and that impacts their investment decisions that threaten the future of communities. So Lisa Gonzalez and I talk about consolidation in the wake of Google buying Webpass and UC2B's partner iTV-3 selling out to Countrywide Broadband. And we talk about why Westminster's model of public-private partnership is preferable to that of UC2B. We also discuss where consolidation may not be harmful and how the FCC's order approving the Charter takeover of Time Warner Cable will actually result in much more consolidation rather than new competition.

This show is 18 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Fifes and Drums of the Old Barracks for the music, licensed using Creative Commons. The song is "Cork Hornpipe."

On the heels of releasing our video on Ammon, Idaho, we wanted to go a little more in-depth with Bruce Patterson. Bruce is Ammon's Technology Director and has joined us on the show before (episodes 173 and 86). We recommend watching the video before listening to this show. We get an update from Bruce on the most recent progress since we conducted the video interviews. He shares the current level of interest from the first phase and expectations moving forward. But for much of our conversation, we focus on how Ammon has innovated with Software-Defined Networks (SDN) and what that means. We talk about how the automation and virtualization from SDN can make open access much more efficient and open new possibilities. Check out Ammon's Get Fiber Now signup page or their page with more information.

This show is 27 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Forget the Whale for the music, licensed using Creative Commons. The song is "I Know Where You've Been."

Depending on where you live, you may be able to choose between two or three big name ISPs. No matter which one you ultimately select, you might face some difficulty obtaining the kind of service you deserve. If you know what to expect, it’s easier to prepare yourself and, in the event you DO have a choice, pick the one that’s right for you.

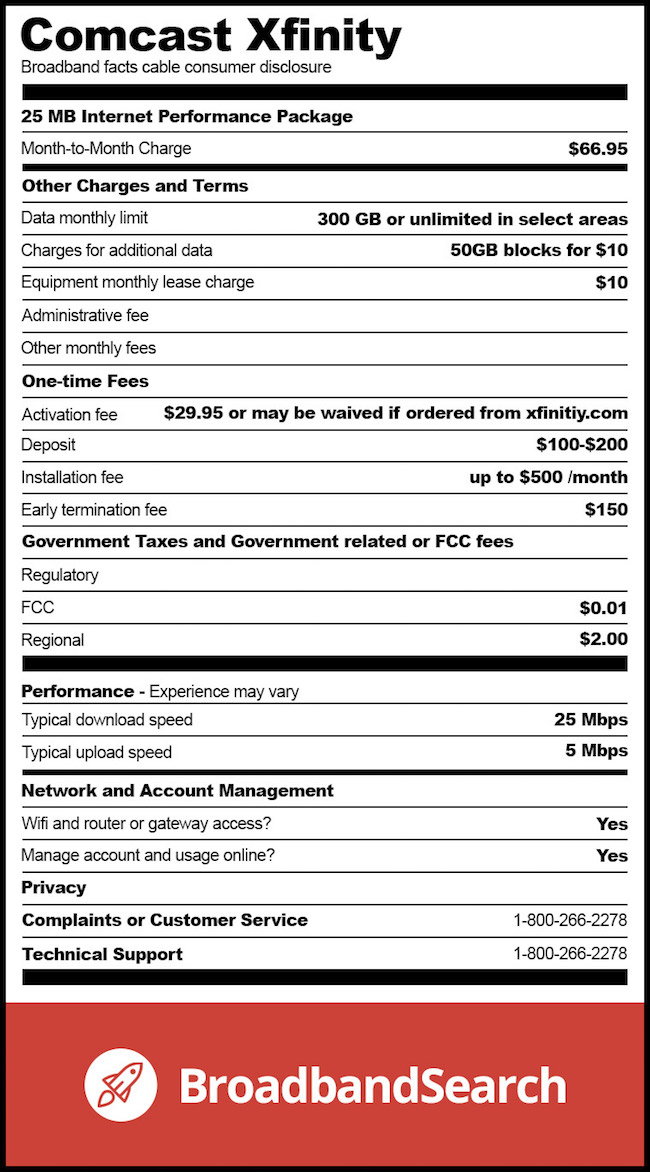

BroadbandSearch has likened transparency in the telecommunications industry to nutrition information on food packaging. They have produced a set of “Nutrition Labels” for your Internet access diet.

They describe the project:

We believe that anything that makes buying broadband Internet service easier is a good thing, and for that reason we've created these ready-made broadband nutrition labels to help you choose from the biggest providers in the nation.

Here is Comcast’s Xfinity label, a big provider in our Minneapolis area.

Of course, rates from Xfinity and other providers vary from place to place and they offer introductory deals that depend on a number of factors. For more on how BroadbandSearch obtained their data, check out their Sources page.

Now that the FCC’s network neutrality rules have been challenged and upheld in the Appellate Court, providers are required to be more transparent. These labels can help them share the information that subscribers need to make informed decisions. Check out the complete set at BroadbandSearch.

In our experience, just about every community considering building a community network considers open access. They want to enable new choices for services and often would prefer the local government avoid directly competing with existing service providers, for a variety of reasons. However, we are only tracking 30 open access networks on our just-released Open Access resource page.

Many of the communities that start off enthusiastic about open access ultimately decide to have a single service provider (themselves or a contractor) to have more certainty over the revenues needed to pay operating expenses and debt. We believe this will change as the technology matures and more communities embrace software-defined networks (SDN) -- but before tackling that topic, we think it is important to discuss the meaning of open access.

On a regular basis, I get an email from one deep-thinking person or another that says, "That network isn't really open access." They almost always make good points. The problem is that different people embrace open access for different reasons - they often have different expectations of outcomes. Understanding that is key to evaluating open access.

How Many ISPs?

One of the key questions centers on how many providers a household is likely to be able to choose from. Various factors, including the network architecture and economics of becoming a service provider, will influence this outcome.

Some communities simply seek to avoid a monopoly network - they are focused on the idea of potential competition. For instance, we believe Huntsville's model and agreement with Google can be considered open access because any party could lease fiber from the utility to compete with Google. However, we believe the costs of doing so by using that network architecture make robust competition unlikely.

In Tennessee, this month marks 10 years of Morristown Utility Systems delivering fiber-optic triple-play service to the community, including great Internet access. But those living just outside the city and in nearby cities have poor access at best. MUS General Manager and CEO Jody Wigington returns to our show this week and we also welcome Appalachian Electric Cooperative (AEC) General Manager Greg Williams to discuss a potential partnership to expand Morristown services to those that want them. As we have frequently noted, Tennessee law prohibits municipal fiber networks from expanding beyond their electric territories. The FCC decision repealing that favor to the big cable and telephone company lobbyists is currently being appealed. But Tennessee also prohibits electrical co-ops from providing telephone or cable TV service, which makes the business model very difficult in rural areas. Nonetheless, MUS and AEC have studied how they can team up to use the assets of both to deliver needed services to those outside Morristown. We discuss their plan, survey results, the benefits of working together, and much more.

This show is 24 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Forget the Whale for the music, licensed using Creative Commons. The song is "I Know Where You've Been."

The American Cable Association (ACA) represents over 800 small and medium-sized cable companies around the United States, including many municipal cable and fiber-optic networks. This week, we talk with ACA President and CEO Matt Polka about what they do and how small cable companies are vastly different from the big companies like Comcast and Charter. We spoke after it was clear Charter's merger with Time Warner Cable would be approved, but before this article in Ars Technica effectively missed the point of Matt Polka's objection to the competition requirement in the merger. In our interview, we discuss the larger problem - that the federal government consistently puts its thumb on the scale to benefit the biggest cable companies at the expense of smaller ones. Forcing Charter to compete with Comcast would be a far bigger benefit to communities than having it take over small cable networks. We wrap up with a discussion about how smaller companies, which includes all municipal networks, are disproportionately impacted by regulations that do not distinguish between the biggest providers (that tend to cause the majority of problems) and the smaller providers (that bear the brunt of regulations designed for reigning in the problems caused by the big carriers).

This show is 29 minutes long and can be played on this page or via Apple Podcasts or the tool of your choice using this feed.

Transcript below.

We want your feedback and suggestions for the show-please e-mail us or leave a comment below.

Listen to other episodes here or view all episodes in our index. See other podcasts from the Institute for Local Self-Reliance here.

Thanks to Forget the Whale for the music, licensed using Creative Commons. The song is "I Know Where You've Been."