Fast, affordable Internet access for all.

Last November, we reported on a change to the tax code that is deterring rural telephone and electric cooperatives from leveraging government funding to expand broadband access. We were alerted to the issue by the office of Senator Tina Smith (D-MN), who sent a letter to Treasury Secretary Steven Mnuchin and IRS Commissioner Charles Rettig requesting that they remedy the issue and announcing her intention to introduce corrective legislation.

Federal elected officials have introduced such a measure, called the Revitalizing Underdeveloped Rural Areas and Lands (RURAL) Act. Senator Smith together with Senator Rob Portman (R-OH) introduced the Senate version of the bill, S. 1032, in early April, followed by Representatives Terri Sewell (D-AL) and Adrian Smith (R-NE), who introduced a companion bill, H.R. 2147, in the House a few days later. The RURAL Act would ensure that co-ops, which are many rural communities’ only hope for better connectivity, could take full advantage of federal and state funding for broadband networks.

Addressing Legal Ambiguity

A new Pew Research Center survey reveals that 70 percent of adults, regardless of political leanings, believe local governments should be able to invest in municipal Internet networks.

Local Authority Has No Party

The survey, conducted March 13 - 27 supports the finding that local authority for telecommunications decisions is a bipartisan notion. On closer examination of the survey results, we see that 67 percent of Republicans and Republican leaning respondents and 74 percent of Democrats and Democratic leaning respondents support local authority to invest in municipal networks.

In Colorado, two more local communities voted this month to opt out of the state’s restrictive SB 152. The law prevents local communities from investing in Internet infrastructure to offer telecommunications services or work with a partner to improve local connectivity. Colorado Springs and Central City became cities 97 and 98 to join the growing list of communities opting out, which includes places that have taken action to deploy and others who merely want the option.

Colorado Springs, known as one of the state’s more conservative communities, passed the measure with 61 percent of the vote, not far from the results of the Pew Research survey.

Colorado Springs, known as one of the state’s more conservative communities, passed the measure with 61 percent of the vote, not far from the results of the Pew Research survey.

Of Growing Importance

The survey also asked U.S. adults about how important high-quality Internet access is at home. Forty-nine percent said home broadband is essential and 41 percent described it as important but not essential. That leaves just one out of ten survey respondents who describe home broadband as either not too important or not important at all.

Respondents also answered questions about assistance to low-income households to help them pay for Internet access. Unlike support for municipal networks, political affiliation, income level, and current access to the Internet appeared to play a part in respondent replies.

On February 7th, the Virginia House of Delegates voted 72 - 24 to pass HB 2108, otherwise known as "Byron’s Bad Broadband Bill." The text of the bill was a revised version substituted by Del. Kathy Byron after Governor Terry McAuliffe, local leaders across the state, and constituents very handily let her know that they did not want the bill to move forward. The bill now moves to the Senate.

Byron’s original “Broadband Deployment Act” has been whittled down to a bill that still adheres to its main purpose - to protect the telephone companies that keep Byron comfortable with campaign cash. There is no mention of deployment in the text of the new draft, but it does dictate that information from publicly owned networks be made open so anyone, including national providers, can use it to their advantage.

According to Frank Smith, President and CEO of the Roanoke Valley Broadband Authority (RVBA),

...Virginia Freedom of Information Act stipulations already codified in the Wireless Services Authority Act are sufficient and the new requirements in Byron’s bill could require the broadband authority to reveal proprietary information about its customers.

...

“There’s nothing hidden under the table,” Smith said. “The Wireless Services Authority Act is sufficient because you all did your job in 2003.”

The broadband authority’s rates, books and board meetings already are open to the public.

Not "Us" vs. "Them"

We have recently covered state laws preempting local control, especially in North Carolina and Tennessee. State governments are supposed to be “laboratories of democracy” and municipalities are sub-parts of the state. Preemption is ostensibly to prevent problems, but instead these state laws limit local governments’ solutions for ensuring better connectivity.

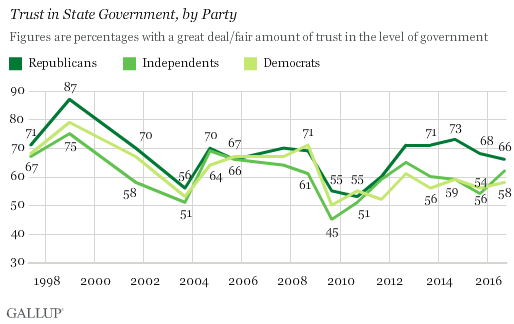

At the same time, people trust their local government more than their state government to handle problems. That’s the latest finding from Gallup’s most recent Governance Poll, and that makes sense for all of us following community networks.

It's no surprise that trust starts with local community leaders. We have spoken to a number of public officials that acknowledge that when you know your elected official - perhaps live down the street from them or run into them at the grocery store - it's much easier to know that they share your hopes for the community.

Polls, Trends, and Republicans

Gallup’s September 7th-11th Governance Poll found that 71 percent trust their local government to handle problems, but only 62 percent say the same about their state government. This continues a fifteen-year trend of people putting their faith in local government more than in state government.

Seventy-five percent of Republicans stated that they have a "great deal/fair amount" of trust in local government. (Compare to only 71 percent of Independents and 66 percent of Democrats.) This corresponds with what we found in January 2015 while analyzing our data. Most citywide, residential, municipal networks are built in conservative cities. They trust local governments to solve connectivity problems when the big providers can't or won't deliver.

Image of the graph on trust in local and state governments from Gallup

Alabama Republican State Senator Tom Whatley tried again this session to convince his colleagues that municipal utilities need the ability to expand beyond current coverage areas. Once again, his appeal to common sense for better connectivity fell on deaf ears.

Deja Vu

Whatley, representing the Auburn region, held fast to his promise to bring back a proposal like 2015’s SB 438. Early in February, he introduced SB 56, which stalled in the Senate Transportation and Energy Committee, unable to get a hearing. The bill eliminated limitations on both services offered and where municipal systems can offer those services.

In a January OANow article, Whatley explained that, once again, he was driven by the desire to improve economic development in Auburn:

On the local level, Sen. Tom Whatley, R-Auburn, is sponsoring two bills that he hopes will drive industry to and create jobs in Auburn and Opelika. An Internet availability bill would allow municipalities that offer their own high-speed [gigabit] Internet service, such as the city of Opelika, to expand and offer it in other areas, such as in Auburn and Russell or Tallapoosa counties, which are not eligible for [gigabit] service through private Internet companies.

“The [gigabit] service is something that businesses look for,” Whatley said, adding industries look at [gigabit] Internet the way they do school systems and water and sewer before moving their business into a city. “It’s an economic development tool.”

To Spread The Wealth

As we have learned, communities with municipal networks have tended to be politically conservative. Nevertheless, conservative state level politicians have often supported measures to revoke local authority to encourage local Internet choice. Recently, Alabama State Senator Tom Whatley, a Republican from Auburn, expressed his support for local authority in AL.com.

Whatley introduced SB 438, which would remove service area restrictions on municipal providers and remove the currently restriction preventing other municipalities from providing voice, video, or Internet access services. As he notes in his opinion piece, the bill did not move beyond the Transportation and Energy Committee, but he also asserts that he will be back next year to press for the measure.

Auburn is near Opelika where the community has deployed a FTTH network to serve residents and spur economic development. If the restrictions are eliminated, Opelika could expand to Auburn and even other rural areas nearby.

Whatley makes comparisons to the strides America made with the national interstate system. He also acknowledges the way Chattanooga's network has transformed what was once described as the "dirtiest city in America." Whatley takes the same approach we encounter from many communities where, after failed attempts to entice private providers to serve their citizenry, eventually decided to take on the task themselves.

He writes:

As a Republican, I believe the private sector is usually the best and most efficient method for providing a service. But when private companies, for whatever reason, make a decision not to serve an area, we should not handcuff the people of that region if they decide to use a public entity to receive that service (in this case, broadband Internet) in order to compete today for the jobs of tomorrow.

The Orlando Sentinel published this op-ed about local government action for broadband networks on March 11, 2015.

Local governments should make broadband choices

By Christopher Mitchell

Community broadband must be a local choice, a guest columnist writes.

When Comcast announced plans last year to invest hundreds of millions in theme parks in Florida and California, its customers may have wondered why the cable giant wasn't using those funds to deliver a faster or more reliable Internet connection. While Comcast's Universal Studios faces competition from Walt Disney World, most people don't have a real choice in high-speed Internet access.

The Federal Communications Commission has just boosted the broadband definition from 4 megabits per second to 25 mbps. At that speed, some 75 percent of Americans have no choice in providers — they are stuck with one or none.

The rest of America is living in the future, often because their local government rolled up its sleeves and got involved. In some of these communities, the local government built its own network and others worked with a trusted partner. Chattanooga's city-owned electric utility built the nation's first citywide gigabit network, which is about 100 times faster than the average connection today.

Google is famously working with some bigger cities, whereas local provider GWI in Maine has partnered with several local governments to expand gigabit access.

However, the big cable and telephone companies have almost always refused to work with local governments. Instead, they've lobbied states to restrict the right of local governments to build or partner in this essential infrastructure.

In Florida, the law puts restrictions on local governments that do not apply to the private sector, such as a strict profitability timetable that can be unrealistic for large capital investments regardless of being privately or publicly owned. Some 20 states have such barriers that limit competition by effectively taking the decision away from communities.

Republican State Senator Janice Bowling from Tennessee is once again speaking out in favor of local telecommunications authority. On Monday, she published an op-ed in the Tennessean titled "Don't limit high-speed broadband to big cities," noting that rural communities often have no choice but to build their own infrastructure to obtain fast, reliable, affordable Internet access for residents and businesses.

Bowling refers to Tullahoma, her own home town, where economic growth is strong and Internet access is affordable. Tullahoma has a history of increasing speeds without increasing rates and now offers gigabit service for around $100. Unfortunately, Tullahoma is surrounded by communities it cannot help due to the state limitations.

Tennessee's restrictive laws prevent other communities from following in Tullahoma's footsteps. She sees the way these laws hold back people in her home state:

Unfortunately, public broadband networks are impeded by restrictive state laws that limit the power municipals have in providing services. In Tennessee, a 1999 law prohibits municipalities that operate broadband networks from providing service to anyone outside of the boundaries of their electrical footprint. This means that people in rural towns and small communities are still without high-speed Internet.

They’re without educational and employment opportunities, improved modern health care, enhanced public safety or better-quality government services, among other benefits.

…

As a senator representing seven rural counties and a resident of a small community myself, I am speaking out for all of those who are being held hostage to 20th-century technology. Let us grow our economies, improve our governments’ performance and create jobs for in our communities. Let us have Internet choice(s).

In November, Senator Bowling spoke at the Next Century Cities event "Envisioning a Gigabit Future." Below is her presentation on the need for high-speed connectivity and local authority in rural communities.

President Obama is not the only Washington politician who is coming out to describe broadband networks as critical infrastructure. Cathy McMorris Rodgers, a Republican Representative for the 5th congressional district in the state of Washington recently said the same at the Internet Policy Conference, hosted by the Internet Education Foundation in Washington DC.

C-SPAN televised the event and here is McMorris Rodgers as she addresses the question of how involved the federal government should be in developing rural networks.

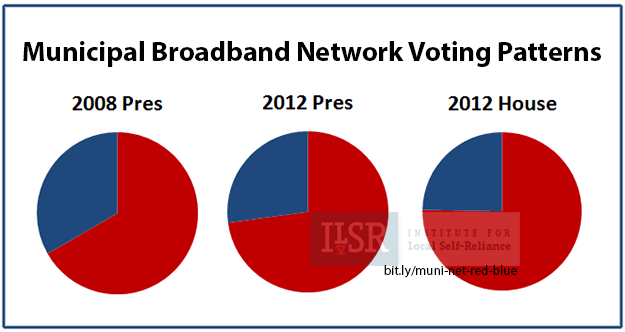

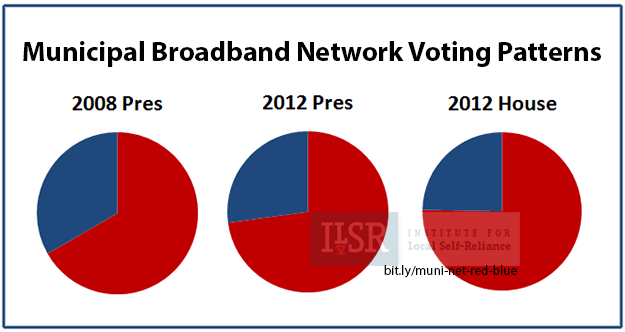

Some 3 out of 4 communities have voted Republican in recent elections, a trend that has become more pronounced across these elections. And as elections in non-presidential years tend to skew more conservative, we would expect the results to show an even greater trend toward voting for Republicans.

With President Obama speaking out in support of community networks, it will be interesting to see how Republicans in the Senate and House react. Some Republicans have taken strong stances to limit local authority in favor of states interfering in local matters like how to ensure businesses have high quality Internet access.

But at the local level, this is an issue of jobs and education, not one of a rigid ideology. We've noted in the past how local Republicans and Democrats have fought side by side on these matters. But last year, National Journal traced the growth of partisanship on municipal networks at the federal level.

In this analysis, we counted each community as one vote. Chattanooga, with its large population counts the same as tiny Windom, Minnesota. We analyzed the data in two different ways to ensure that clusters of municipal networks didn't bias the results.

Some 3 out of 4 communities have voted Republican in recent elections, a trend that has become more pronounced across these elections. And as elections in non-presidential years tend to skew more conservative, we would expect the results to show an even greater trend toward voting for Republicans.

With President Obama speaking out in support of community networks, it will be interesting to see how Republicans in the Senate and House react. Some Republicans have taken strong stances to limit local authority in favor of states interfering in local matters like how to ensure businesses have high quality Internet access.

But at the local level, this is an issue of jobs and education, not one of a rigid ideology. We've noted in the past how local Republicans and Democrats have fought side by side on these matters. But last year, National Journal traced the growth of partisanship on municipal networks at the federal level.

In this analysis, we counted each community as one vote. Chattanooga, with its large population counts the same as tiny Windom, Minnesota. We analyzed the data in two different ways to ensure that clusters of municipal networks didn't bias the results.